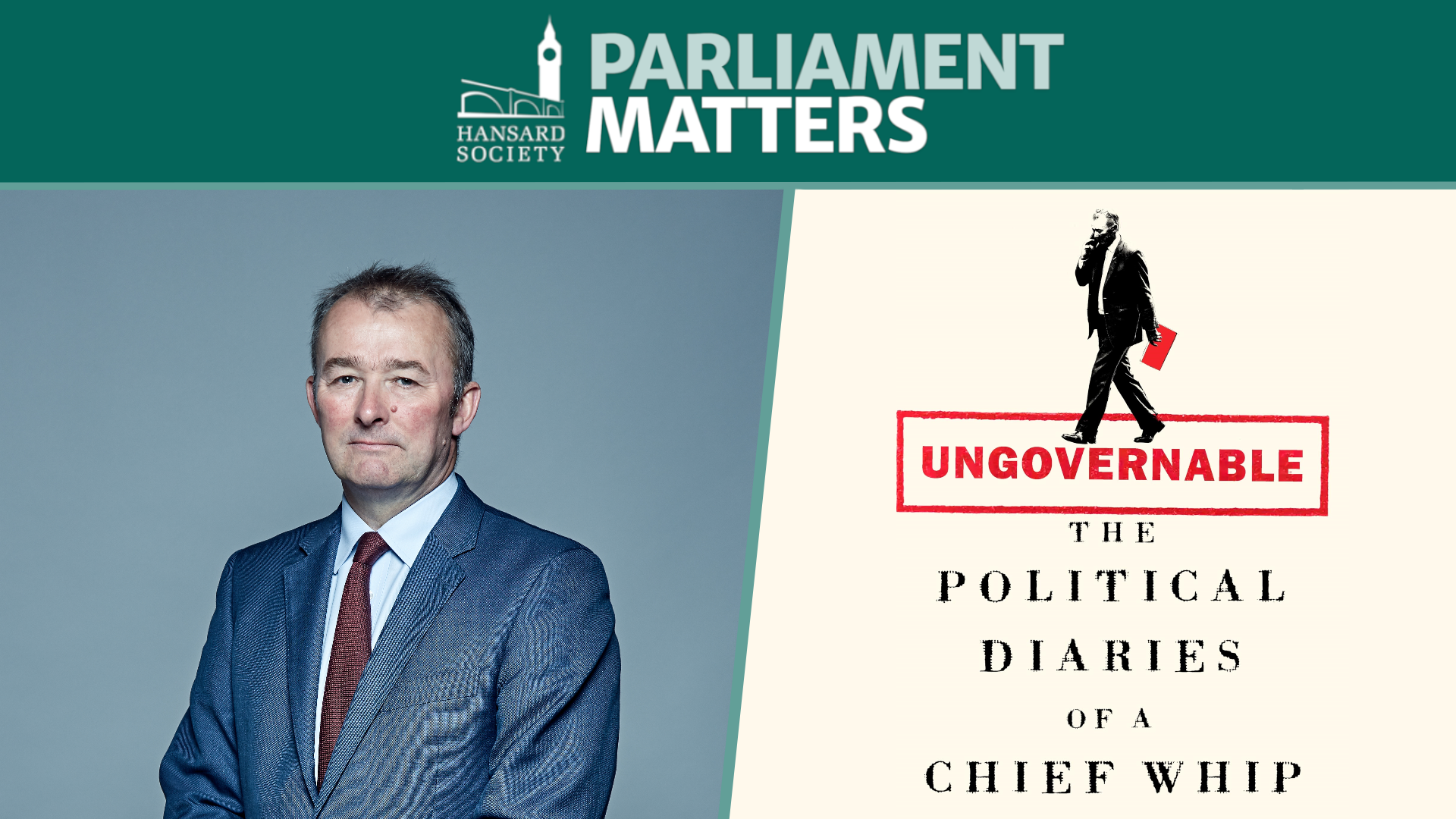

News / Whipping Yarns: A Chief Whip's tale - A conversation with former Chief Whip Simon Hart - Parliament Matters podcast, Episode 87

In our latest ‘Whipping Yarn’, we talk with Simon Hart, former Conservative Chief Whip during Rishi Sunak’s Premiership. Hart opens up about his time in one of Westminster’s most demanding and discreet roles, chronicled in his new book, ‘Ungovernable: The Political Diaries of a Chief Whip’.